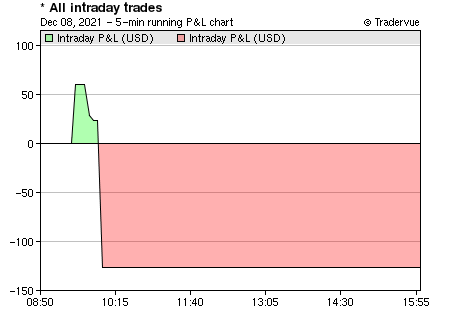

Today was a mess. I didn’t read my emotions correctly, and ended up making multiple mistakes which cost me dearly. Let me explain…

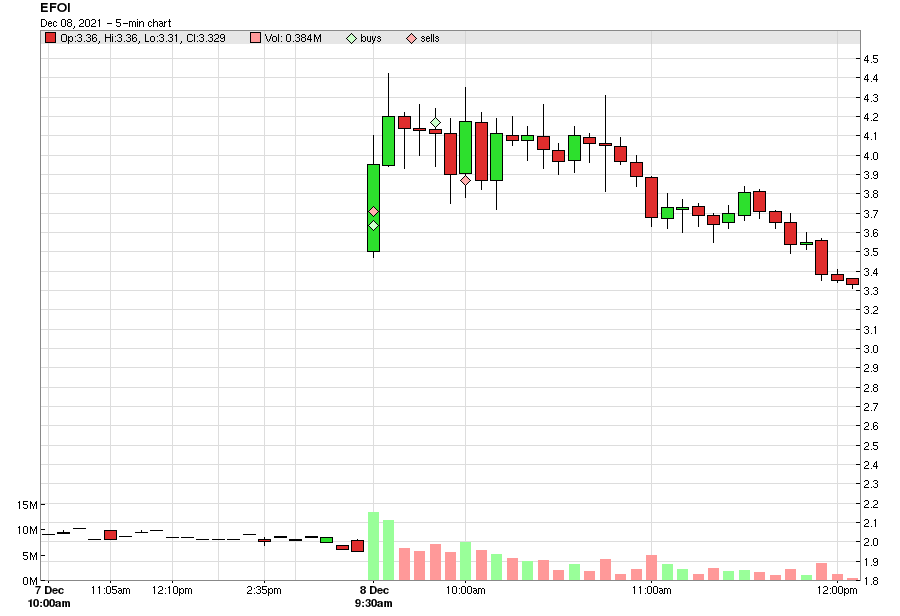

My trade started with a pre-market purchase of EFOI.

So I bought in at $3.48 pre market and was happy with the entry as price action soon went above ~$3.70 and stayed above there for a while when the market opened. Then, I added to that position immediately saw a green 1m candle and I rather too quickly closed out my position for a small gain.

Because of my small position size (note: I’ve been trading smaller position size recently which has been going well and allows me to manage my trades with less emotion), I only made a small gain (regret and greed kicked it).

I also sold too early, due to a lack of Fib planning. So I began to build my first mistake which was fear of missing out (FOMO kicking in as additional green candles filled).

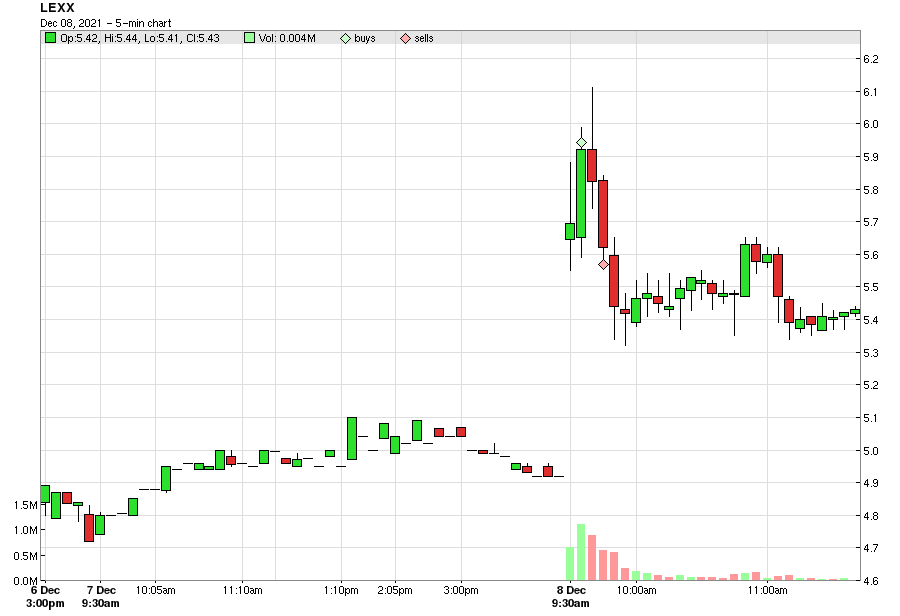

Because I was annoyed that I had sold too early I had not done my Fibonacci is correctly (note: I use Questrade and Fib extension tool does not work well inside of Questrade), I irrationally flipped to another stock LEXX on my watchlist and immediately enter the trade without any research just a few seconds of price action monitoring in level two.

This was a rash mistake which of course did not work out. After a few minutes of watching the stock consolidate I exited through small loss.

At this point I was obviously emotionally charged so when I went back to my original chart of EFOI, with revenge trading plus fear of missing out and a very heightened emotion state – I then proceeded with re-entry even though I knew price action was over extended an overbought. To make up for my losses, on the new trade I entered with a large size.

After consolidating sideways for a few minutes I knew that it was going to drop in price because it had a few failed tops but with a manual stop I waited a little bit too long and exited the trade eventually for a larger loss.

This loss wiped out my daily gains and some.

And so today’s lessons are about poor trading FOMO, revenge trading, two large position size, lack of planning and preparation, impulse trading.

There’s nothing much else to be said other than I let myself down today with very poor emotional trading where I made a number of mistakes in quick succession and of course the result was a loss for the day so this will be a blog post that I remember for a while I think this is the worst trading I’ve done in about 14 days and so I really want to remember this.

Mistakes:

- Lack of Fib extension, target price planning on 1st trade.

- FOMO as I left money on the table on 1st trade.

- Greed on 1st trade.

- Lack of planning on 2nd trade.

- Revenge trading on 2nd trade.

- Revenge trading on 3rd trade.

- Over trading on 2nd and 3rd trade.

- Too big position size on 3rd trade