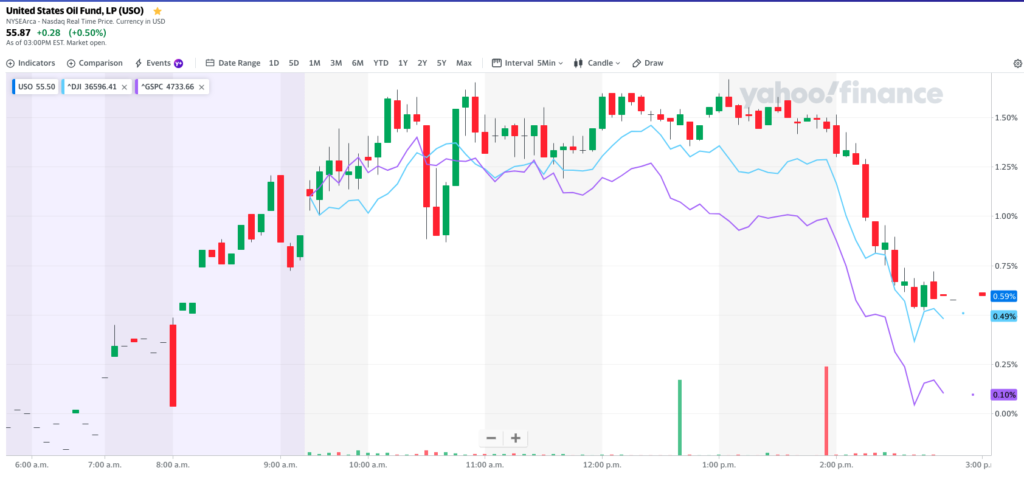

Today I was trading USO, but didn’t see the markets turn negative. You can see from chart below that the USO tracks the wider market closely. See the comparison lines!

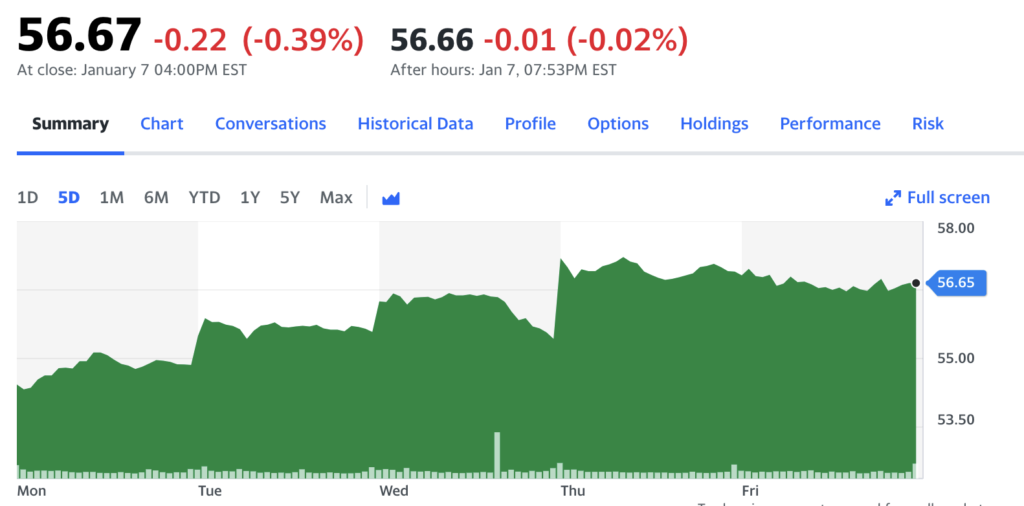

Lesson is to always have DOW, S&P, and NASDAQ on screen to look for a turn in market. There were clear sell signals. I should have sold my USO Calls when I saw the market turn from Bull to Bear! Don’t own CALLS in a Bear market! Nevertheless, I still made 40% on the trade, as the market recovered the next day (in at $0.5800, out at $0.8400 = 44.82%0. Let us review what happened.

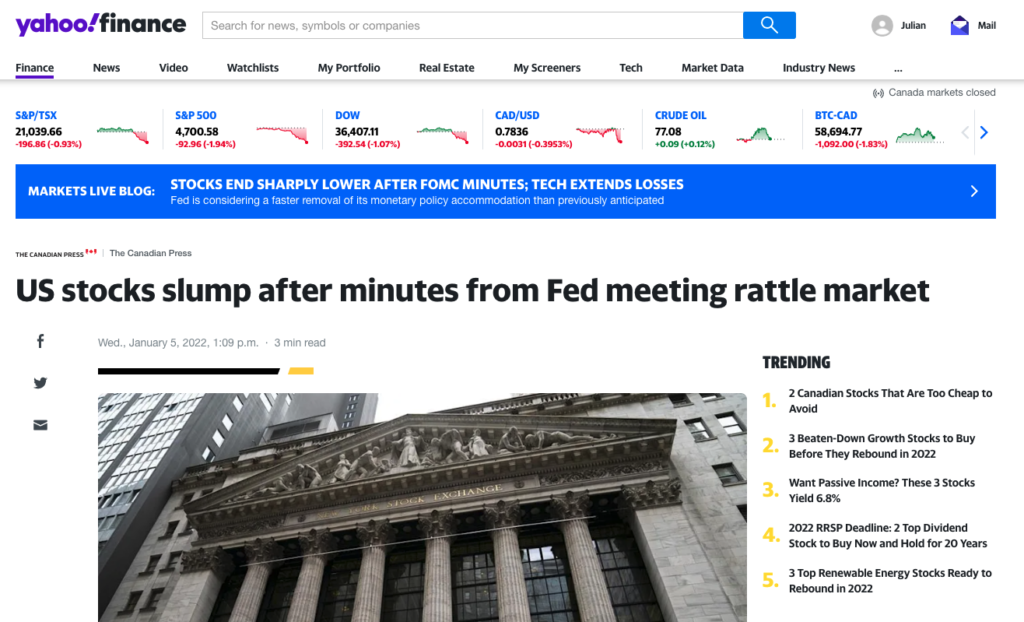

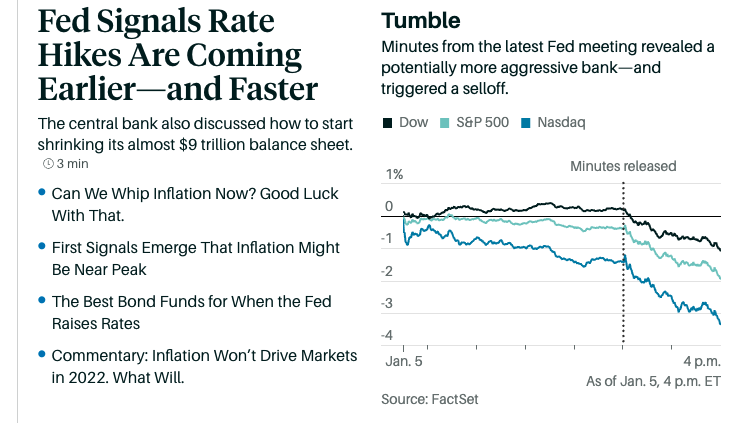

I need to have a calendar of FOMC meetings and releases to avoid this in the future. Look at the screenshot below, how the market turned when the FOMC minutes (negative catalyst) were released!

The sell off was sudden and harsh…

Luckily, overnight (I held overnight) there was a recovery in USO, and I was able to sell for over 40% profit. Perhaps I should give myself more credit – I bought a stock that was clearly in a weekly/daily uptrend, that also had positive new catalysts. Perhaps I was not so lucky, just a little bit early.