Hello everybody my name is Julian with TraderMedic.com and today I just wanted to go over a nice long trade i made this morning on u.s oil this ticker symbol USO.

I made a nice 20.8 percent gain in just a few minutes and so I just wanted to go over how the trade came about how i managed the trade how I exited the trade and any lessons learned.

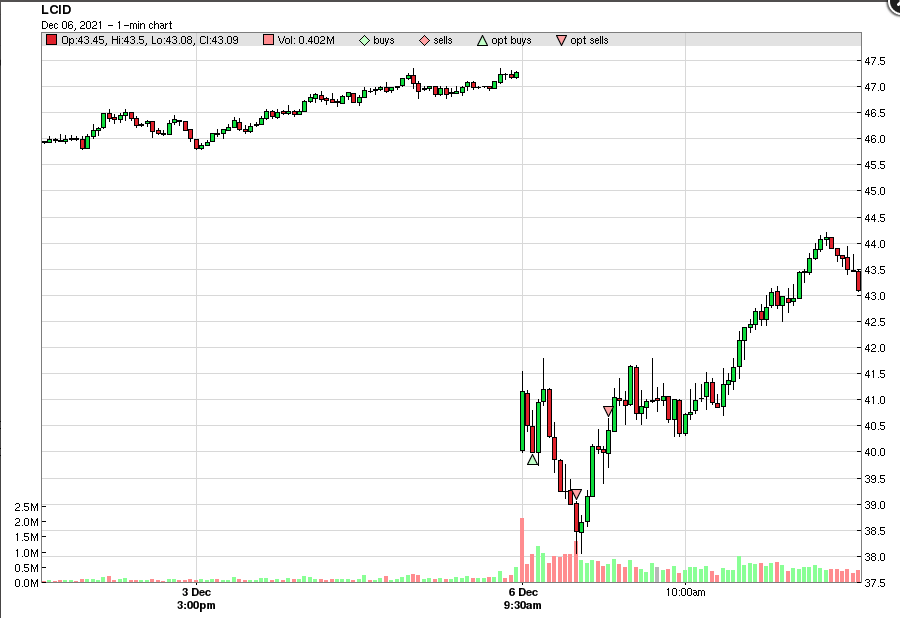

So as you can see the chart on the screen December 7th showing one minute chart – I entered at about two minutes in when i saw a lot of buying volume and i pretty much followed the one minute chart the whole way there was a little point there where it dipped a little bitand luckily did not trigger my mental stop which was the bottom of that second long green candle and then you can see it rallied up to almost 52 dollars just a little shy of that and as you can see in the yellow at the top of the screen, I had a December 10th $51.5 dollar calls, and so we were sitting above that and so I was really happy uh with the trade – I generally just trade the first hour maybe hour and a half of each day because i have commitments at 900 a.m currently, so I was happy to get out of the trade, however it did rally a little bit higher during the day but i was off working on other things so that was the kind of trade.

Also, I thought I would also just show the five minute chart here.

So let me just bring that up so you can see on the five minute chart. There was that extra that extra run it had, so i guess if i was able to trade a little past nine PST then i might have exited (although again it didn’t hit my stop yet) so probably it would have been good just to sit in there a little bit but if i had exited or maybe i would just add to my position as it breaks that kind of what is it $52mark – that would have been a nice little bit of extra trading that i could have one there.

So i think i made kind of half the move basically which again i think is okay for somebody who trades first hour first hour and a half but ideally i would have made that extra part too, so maybe that’s the lesson learned from today but overall i was happy with the trade.

Also, the market was pretty green today as it was rebounding from perhaps overblown Omicron virus fears – so this was kind of the second green day for the market in a row, so i was confident to have that behind me as well that most of the market was green today and oil was already up in the pre-market a couple percent.

So yeah happy with this trade USO, and i’ve done well on this ticker before i’ll keep this in my watchlist for sure!