Let’s be clear. This last year was not a good year from a P/L point of view, but an excellent year from a learning point of view. While I initially believed I could become a consistent, profitable trader in 3 years, I have reset my goal timeline to 4 years. Some might think this is a long time, but you need to understand that I have many other time commitments and can only trade part-time, basically the 1st hour of market open – so it’s going to take longer to become successful than someone who can trade full time.

If I was to quickly summarize why my P/L does not look good this year it’s because:

- Not enough action items from last years lessons.

- Too many non-trading distractions.

To address #2, I simply had too many distractions last year. Not only do I have a full time job (I am an IT freelance consultant), but I also have two (yes two) e-commerce companies, a coworking company, a family and a dog! This was a big distraction. One of the e-commerce companies was taking up a particularly large amount of time, so as trading is my passion, I sold it for profit last year! Although I probably still have too many distractions, the selling of this business has freed up my time significantly. I also intend to be more time efficient this year – I have given up weekly TV shows, and now exercise on my lunch break (everyday, less Fridays!).

To address #1, I made a great list of things I did wrong last year but I did not create actionable steps to address these issues. The list was:

PROBLEM STATEMENTS

(1) risk management – use automatic stop losses (max loss 20% per trade or less),

(2) have more patience – wait for trend, don’t jump into low confidence trades – even if they turn out to be winners,

(3) focus on position sizing – on A trades go large, on other trades stay small. Learn to scale into winning trades!

(4) focus on capital preservation – keep account risk small. preserve capital at all costs. (5) have more discipline!

And so despite my best intentions, I did not manage to achieve these goals. This year however, I will create a list of actionable steps to address these issues, and I am confident that I will tackle these head-on. Let’s start now.

ACTIONABLE STEPS

(1) Risk management

Rule1.1 – Never let a trade exceed 20% loss. Aim for 15% stops.

Rule1.2 – Make sure your entries are patient, so that stop loss is below strong support line (long) or above strong resistance line (short).

Rule 1.3 – Daily loss limit 2% of account.

(2) Have more patience

Rule 2.1 – ENTRY: Wait for bottoming, topping, or trend patterns to emerge. Only trade A+ setups with high confidence.

Rule 2.2 – MGMT: Only exit trades when there is a clear signal to do so. Large profit P/L is not a signal. Must let winners run.

(3) Focus on position sizing

Rule 3.1 – Determine criteria for identifying A+ setups. Do the higher time frames align with your shorter time frame trade? Is the macro market and sector in alignment? What gives you extra confidence in this trade?

Rule 3.2 – Start trades with small contract/stock number. Then, scale into high confidence trades. Utilize pull backs to re-load. Scale in and scale out of trades!

(4) Focus on capital preservation

Rule 4.1 – Nothing is more important than capital preservation.

(5) Have more discipline

Rule 5 – Define what having more discipline looks like, and keep a log of your efforts. Must keep trading journal with discipline rating!

+++

The above list is a start at least, so it’s clearly not good enough to have high level goals, but we must have a tactical list of rules to follow. Furthermore, this year I need to develop a written trading plan and strategy. I struggled to do this before, as I wasn’t sure what trader I was going to be – but now it’s clear. I am a part-time, directional, options trade that trades NASDAQ large cap options. This will be my focus next year. I find that when I trade low float stocks, I don’t do well, as there is not enough data and it also distracts me from my primary options trading goal.

(6) Stick to one strategy

Rule 6.1 – you are a directional options trade, not a short float trader. Stick to your strategy.

I will add to the thoughts above later, but here is the data from my last year trading….again, I include the last few years for comparison:

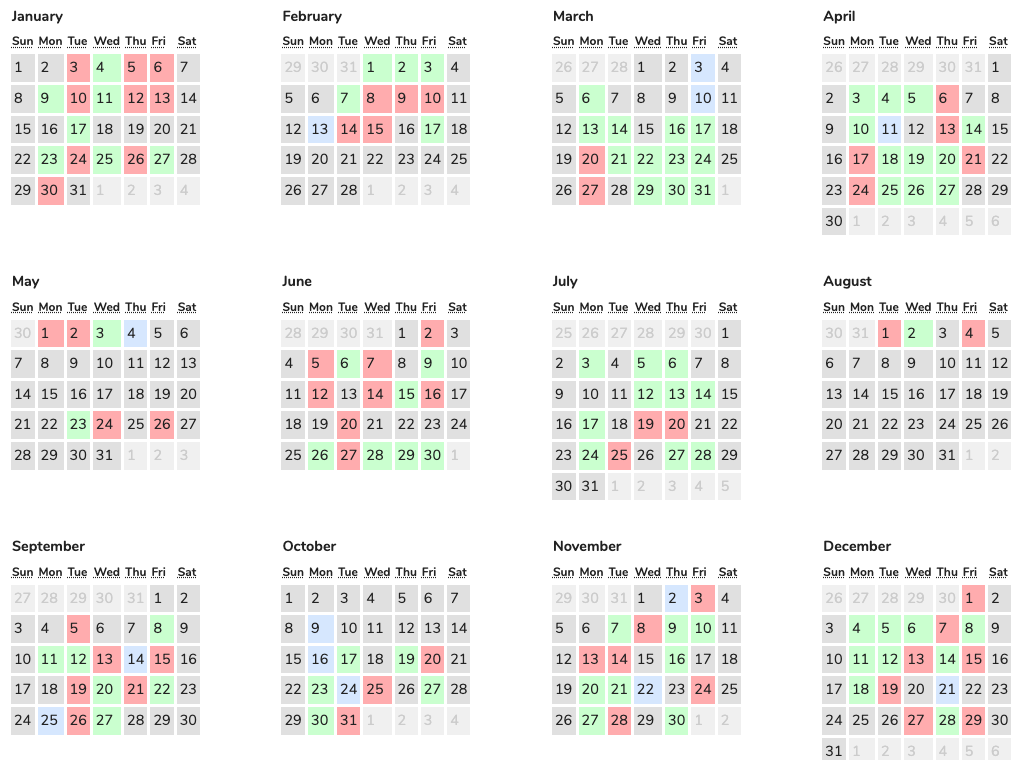

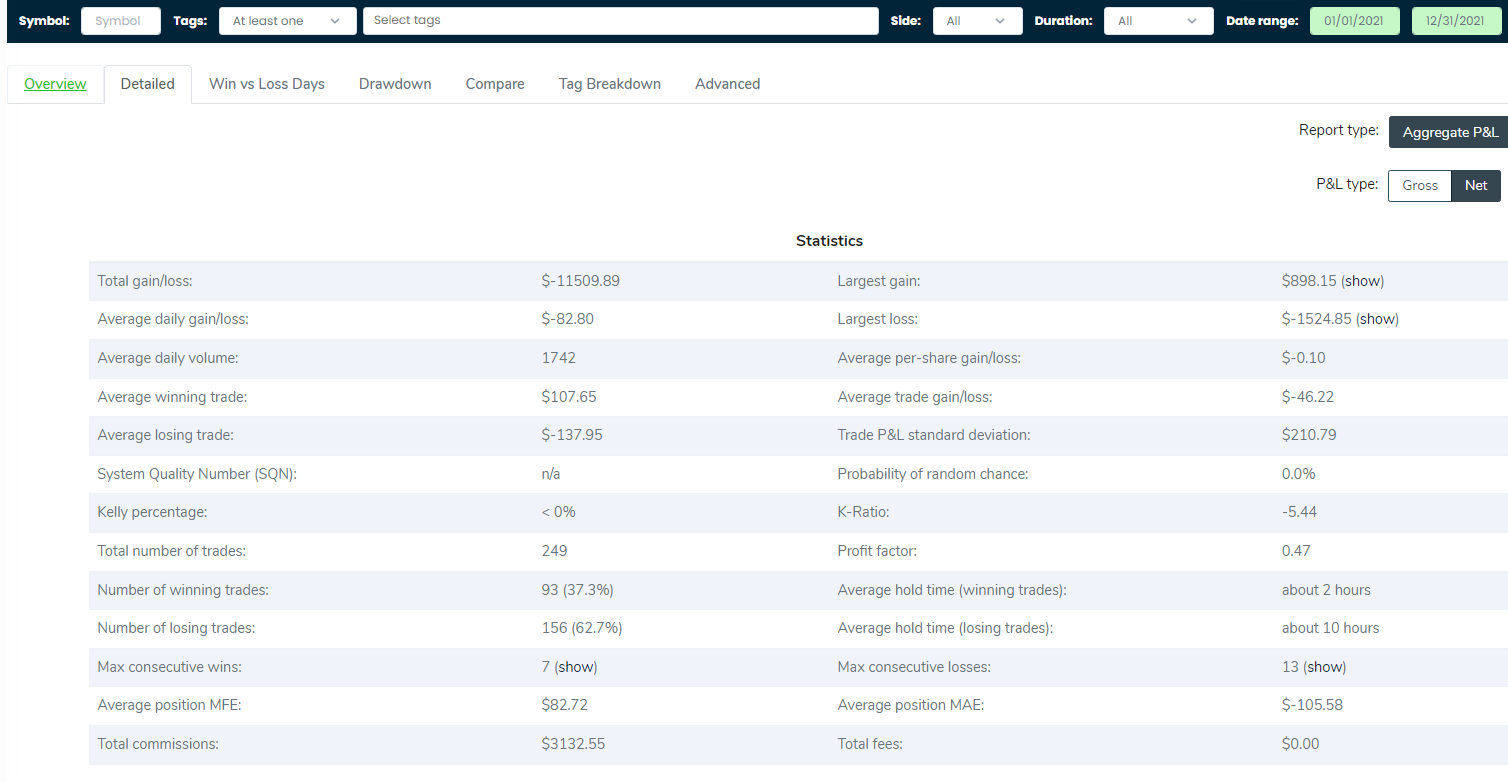

2023

2023

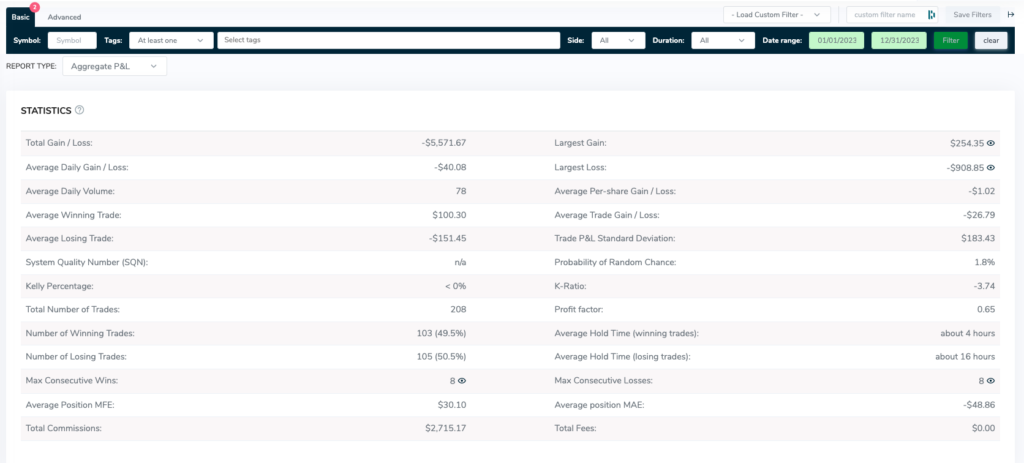

2022

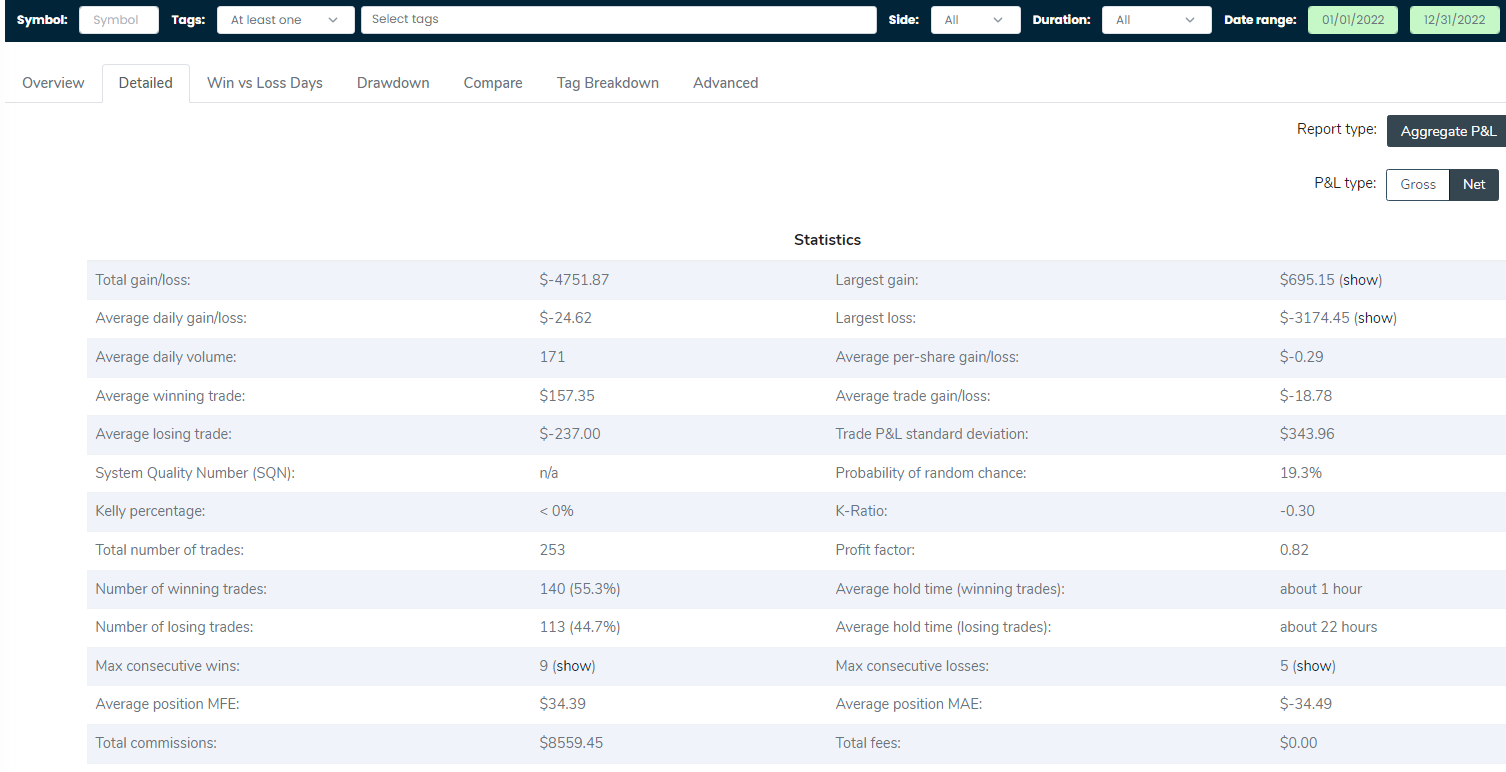

2021

So in summary, I still have a lot to learn as my P/L really sucked last year. However, I also noticed that if I removed my worse 10 trades (out of over 200 hundred!), I would have been profitable – so what does that tell me? I need better risk management, patience and discpline!

Total loss from top 10 trades: $5965.59

Total loss last year NET: 5,579.81

Despite this upsetting lost, this idea is hopeful. Ditch the worst trades, and you’ll be profitable this year. I truly see that only being able to trade the 1st hour is like “altitude training” – it’s much more difficult than if I could trade longer each day. So I need extra discipline, extra patience, and extra consistency.

I’ll be writing more soon on the following topics…

- My new trading setup – I’ve moved away from Questrade and into IKBR (with Das Trader)

- I’m learning how to trade futures, with the goal of one day being a remote prop trader. I aim to start taking prop firm challenges to see how I compare, and what I can learn from the process.

- I’m learning how to use hot keys for faster entry (Das Trader)

- I’m tutoring other beginner traders and creating online videos that act both as my own learnings but also as tools for others.

Anyway, until next time…happy trading!

- The Trader Medic