One of the hardest things in trading, is reviewing your mistakes and admitting your faults. 2022 was my second full year trading. Overall, I made a lost, albeit much smaller than my first year (2021). Still, there were months where I was up a lot, only to loose it all the next month. Overall, I think I lacked a solid risk management plan. I must avoid large losses this year by using automatic stop losses all the time. Overall, my gross revenue was positive – which means I am also over trading (too much commissions!). As I was still in learning phase last year, I’m not too worried about over trading – but this year that ends! I had a three year plan to become a profitable day trader – so 2023 must be a good year for me! These are the main areas of focus for me!

(1) risk management – use automatic stop losses (max loss 20% per trade or less),

(2) have more patience – wait for trend, don’t jump into low confidence trades – even if they turn out to be winners,

(3) focus on position sizing – on A trades go large, on other trades stay small. Learn to scale into winning trades!

(4) focus on capital preservation – keep account risk small. preserve capital at all costs. (5) have more discipline!

The above ideas are hunches, but lets look at the data!

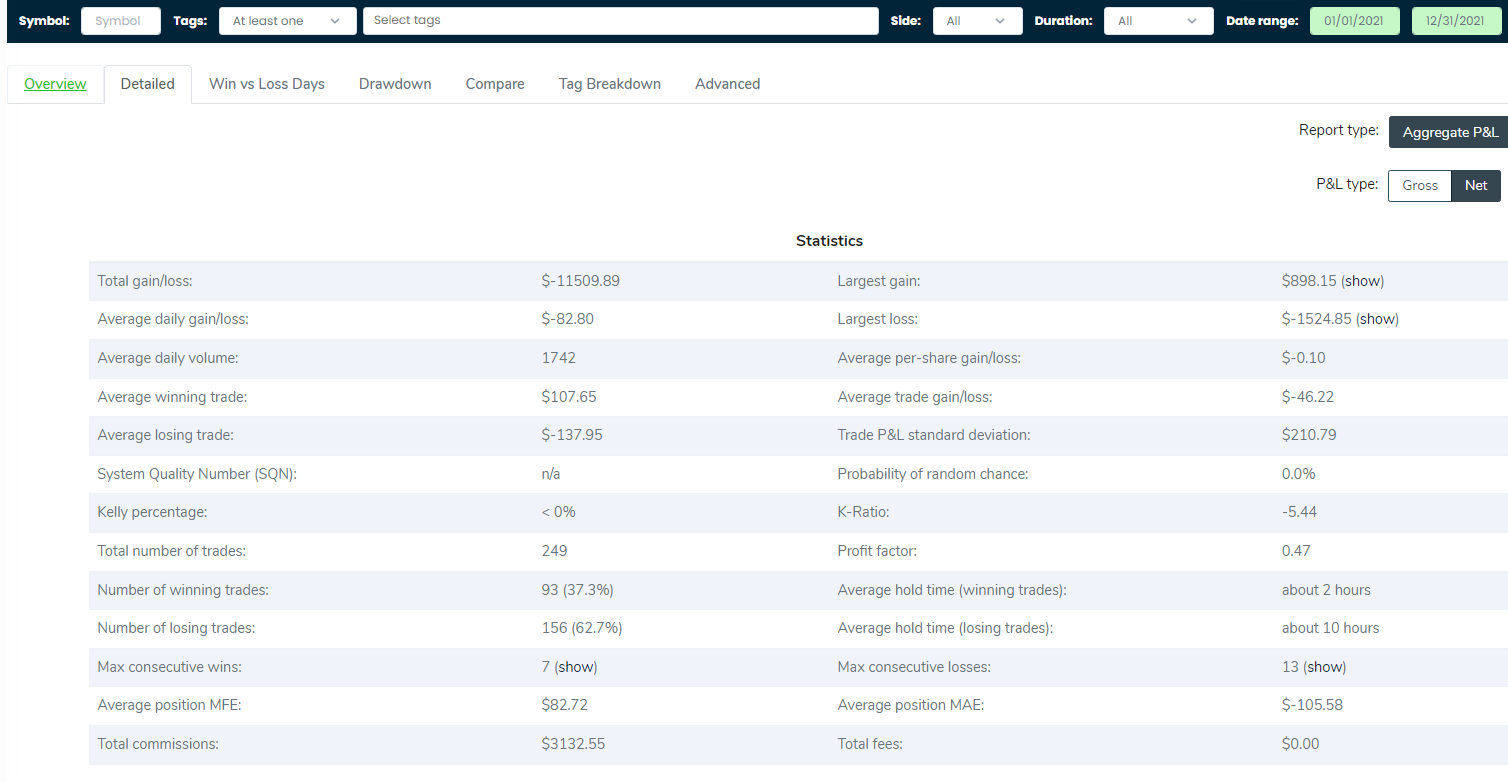

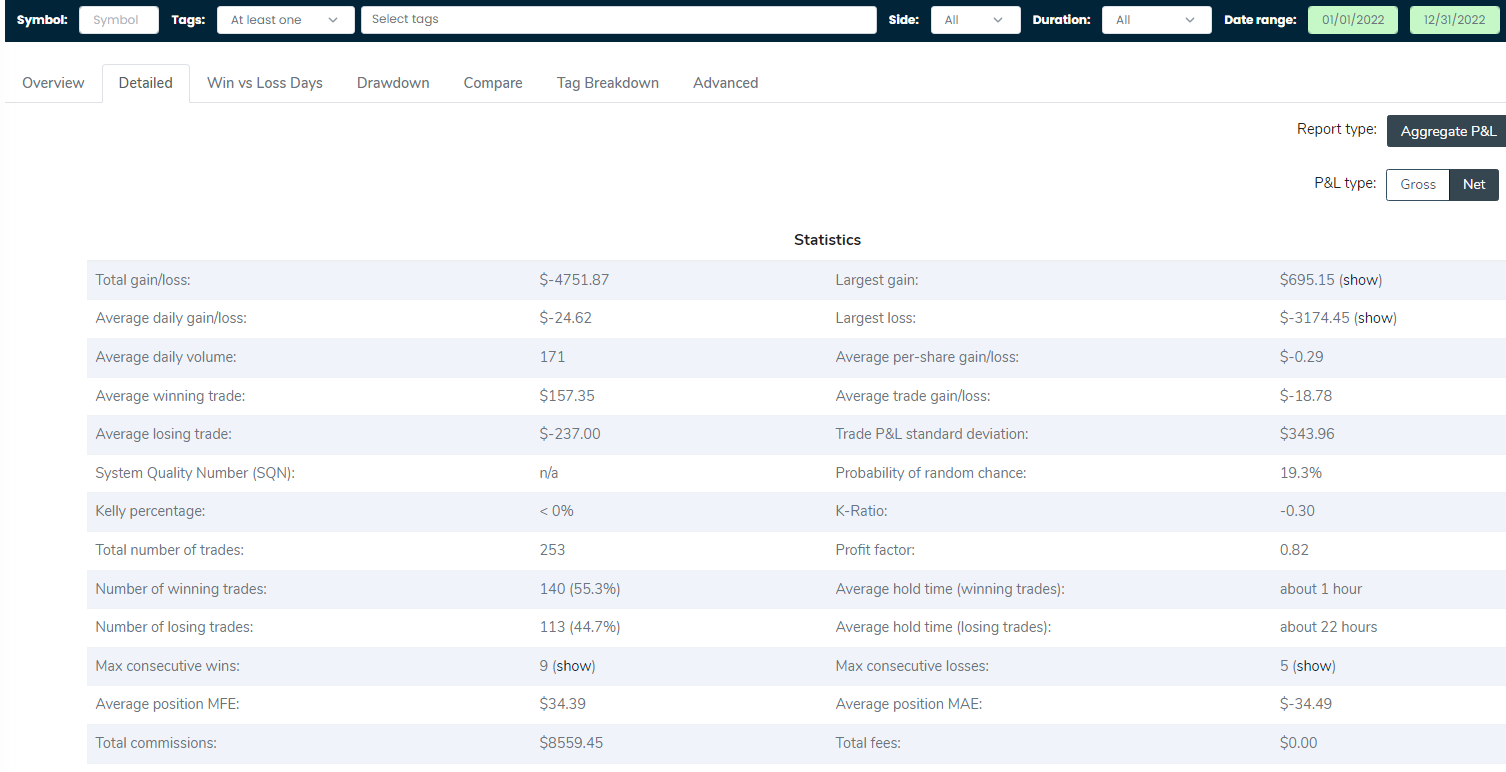

Below I compare my first two years!

2021

2022

If you are an experienced trader, let me know in the comments what you think! Thanks.

VWyLAEJSntRIBThG